- The Investment Exchange

- Posts

- The Investment Exchange

The Investment Exchange

Monday Round Up, Issue 35

Welcome to the latest edition of "The Investment Exchange," your premier source for mergers & acquisitions and investment insights. In this issue, we bring you the latest deals and opportunities plus introduce some of the podcasters, influencers and content creators that are shaping the investment landscape.

Contents

Weekly Update

Current Investment Opportunities - Calla Lily Clinical Care

Current Property Deals - Partnering with a Regulated Financial Broker

Alternative Investment World - Climate Games

Expert Corner - Acquire Scale and Exit (ASE)

Events, Offers and Announcements - Carl Allen

Section 1 - Weekly Update

We have ongoing negotiations with numerous businesses and another member of our accountability group has agreed a new acquisition.

Onwards and Upwards.

I thought we’d start this weeks newsletter with a poll.

Is your current investment strategy.... |

Section 2 - Investment Opportunity: 🌟 Seeking Impact Investors to Fuel Women's Health Innovation! 💡

I am thrilled to present an exceptional investment opportunity with Calla Lily Clinical Care, a groundbreaking women's health startup poised to revolutionise medical device innovation. As we navigate the challenging landscape of women's health, we are proud to offer a unique combination product for intravaginal drug delivery, driven by our proprietary platform device technology.

Here's why Calla Lily Clinical Care stands out:

✨ Mission-Driven Innovation: At the heart of our endeavors lies a commitment to addressing critical gaps in women's health. Our solutions aim to empower women, enhance fertility, and combat prevalent issues such as miscarriage, preterm birth, and bacterial vaginosis.

💰 Seed Investment Opportunity: With £1 million needed to close our seed investment round, your partnership is crucial in propelling our mission forward. We have already secured £740k and are seeking strategic investors to join us in this transformative journey.

🔬 Cutting-Edge Technology: Our platform device technology holds immense promise not only in women's health but also in men's health through rectal delivery applications. With multiple patents covering both intravaginal and rectal delivery, we are positioned for exponential growth and impact.

🌍 Global Impact: Beyond our innovative products, we are actively engaged in securing grants and partnerships on a global scale. With £1.1 million in grants received and significant funding applications underway, including collaborations with prestigious institutions like Sweden's Karolinska Institutet, our reach extends far beyond borders.

📈 Market Traction and Recognition: Calla Lily Clinical Care has garnered substantial interest from industry leaders, evidenced by multiple strategic partnerships and coverage in renowned publications such as Forbes, The Wall Street Journal, and the BBC.

As we continue to advance our mission of unlocking the vast medical potential of the vagina, we invite impact investors to join us in shaping the future of women's health. Together, let's make a meaningful difference in the lives of millions while driving sustainable growth and innovation.

For further details and investment inquiries, please don't hesitate to reach out. Your support is instrumental in realizing our vision for a healthier, more inclusive world.

Thank you for considering this transformative opportunity.

Warm regards,

Thang

Contact [email protected] for more information

Section 3 - Property - 🏢🏠 Unlocking Investment Opportunities: Partnering with a Regulated Financial Broker 🌟

Are you eyeing potential property investments, whether it's commercial, residential, or a mix of both? Before taking the plunge, consider the invaluable partnership of a regulated financial broker. Here's why:

🔍 Tailored Advice and Access: A reputable broker offers tailored financial guidance and access to a vast network of lenders, ensuring you secure preferential rates and terms tailored to your investment goals.

🏢 Case Study: Let's delve into a prime example showcasing the strategic prowess of a seasoned broker. Recently, a broker based in Mayfair, London, orchestrated a stellar deal for an expat keen on purchasing a semi-commercial property—a building housing a shop on the ground floor and three flats above.

📝 Legal and Lease Structure: Through meticulous planning, the broker facilitated the purchase under a Special Purpose Vehicle (SPV), creating separate leases for each flat under distinct SPVs. This structuring not only enhanced legal clarity but also optimized financial outcomes.

💼 Financial Strategy: Leveraging their expertise, the broker submitted three distinct mortgage applications—one for each leasehold flat—maximizing valuation potential and mitigating risk.

💰 Valuation and Outcome: By treating each flat individually during valuation, the broker achieved higher valuations compared to a combined approach, rendering the commercial and freehold components unencumbered.

📊 LTV Consideration: The transaction was executed at a favorable Loan-to-Value (LTV) ratio of 65%, with LTV determined by the property's commercial aspect.

⚖️ Risk Mitigation: Through the use of separate SPVs and leases, the broker bolstered risk management and legal clarity, ensuring a smoother transaction process.

📈 Financial Gain: Opting for individual valuations and separate SPVs yielded a more favorable financial outcome for the client, showcasing the broker's commitment to maximizing client returns.

🌐 Building Long-Term Relationships: When venturing into property investments, establishing a long-term relationship with an established broker is paramount. With their expertise and network, they can navigate complexities and unlock lucrative opportunities tailored to your objectives.

Ready to explore investment opportunities with a trusted partner? If you're seeking introductions to reputable brokers like the one in Mayfair, London, don't hesitate to reach out. Your future investments deserve seasoned guidance and strategic insight.

Let's embark on a journey of financial prosperity together. Get in touch today!

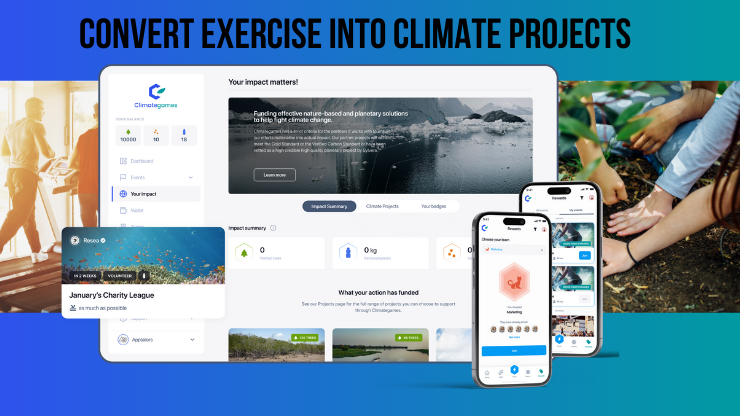

Section 4 - Alternative Investment: Climate Games

We are switching gears from the usual alternative investment ideas and looking towards the topical Climate Change.

You can now pre-register to become a shareholder in Climategames on Seedrs.

With a new look platform organisations can choose the climate projects they wish to fund and engage thousands of employees, fans or community groups through exercise, rewarding them with planetary impact. Every workout, run, walk, swim, row or cycle helps to restore our planet.

In 2023 our Climategamers logged over 200,000 logged activities covering over 2 million km from their exercise. We increased our community to 8,900 users and are now in over 140+ counties.

They have some brilliant new projects which have just landed on our platform including; mangrove protection, seagrass planting, kelp, coral reef gardening and two exclusive projects with NGOs reducing emissions and protecting forests in the Amazon.

Check it out below:

Section 5 - Expert Corner:

Acquire Scale and Exit (ASE) offers a revolutionary Exit Maximisation System tailor-made for SME owners targeting a profitable business exit. This unique approach ensures strategic, financial, and operational excellence, positioning your business for a premium exit. Choose ASE to secure your business's legacy and unlock a path to a rewarding exit backed by industry expertise and a proven track record. ASE's second specialty is getting your company all of the capital that it qualifies for.

Email Edgar for a complimentary 25-minute consultation at [email protected].

Section 6 - Events, Offers and Announcements: 🌟 Unlocking Opportunities in 2024! with Carl Allen 🚀

Exciting news! 🎉 On the 6th of February, Carl Allen is inviting you to an exclusive Investor Meet-Up happening in Birmingham, UK.

Get ready to network with potential partners and investors while delving into the strategies and insights to leverage your expertise for acquiring cash-flowing businesses this year.

Here's what's in store:

🔍 Discovering Distressed Sellers: Learn the art of finding profitable businesses from distressed sellers, including insider tips from our UK partner on initiating conversations with targeted UK businesses.

⏱️ Acquire in 60 Days or Less: Explore the ripe opportunities in various industries with a surge in retirements, enabling swift business acquisitions in 60 days or less.

💼 Mastering Business Acquisition: Gain insights into structuring deals creatively and explore the lucrative Consulting for Equity model that's ripe for exploration.

💰 Valuation Frameworks: Understand the intricacies of valuing businesses through real-life examples shared by our UK partner, offering valuable insights into current purchase trends.

Plus, seize the chance to forge new partnerships, establish valuable connections, and meet potential investors to fuel your ventures.

For all the details and to secure your spot, check out the link below.

We hope you find this edition of "The Investment Exchange" informative and valuable. Your feedback and suggestions are important to us, so please feel free to reach out to us with any comments or ideas for future editions.

Happy investing!

Ross Tomkins, Key Person of Influence @ The Investment Exchange

Note: This content is intended for informational purposes only and does not constitute financial advice. Please consult with a professional advisor before making any investment decisions.